Compares the technology position to thousands of past results for a stronger buying position – delivered in half the time.

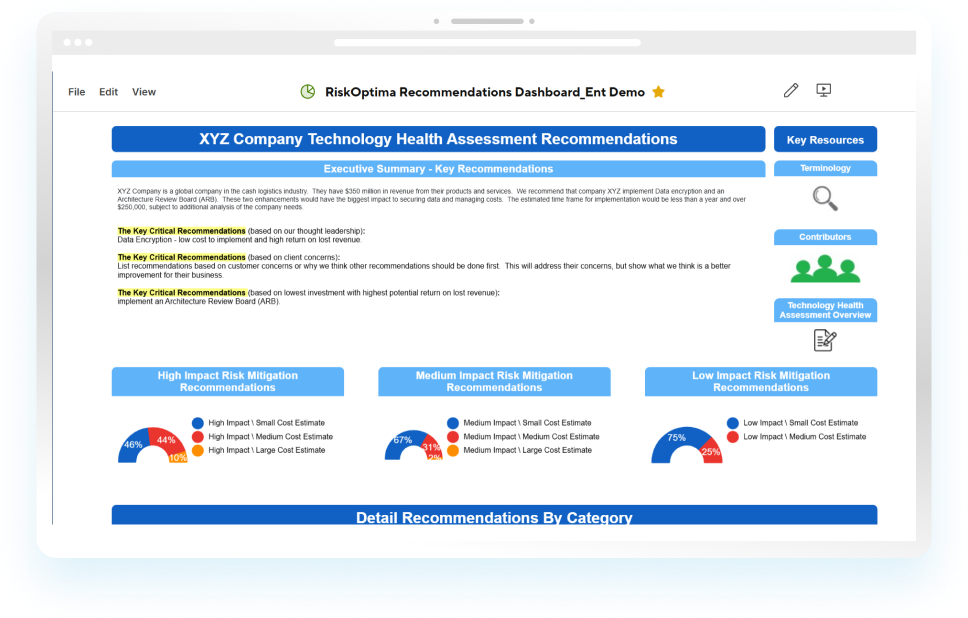

Just like Quality of Earnings provides financial clarity, our Due Diligence does the same with Financial Risk Mitigation by identifying areas of risk for IT Security (includes AI), Infrastructure, and Applications, how to mitigate the risks with cost impact, and a risk mitigation roadmap. All in our Findings and Recommendations Executive Dashboards.

Map your technology landscape to uncover risks, and get expert solutions with estimated costs to fix them.

Turn gut feelings into strategic action with our solution roadmaps and industry benchmarks.

An engine of 400+ best practices, created by SME’s with CIO oversight for maximum impact.

We understand and have seen the results of technology acquisitions without quality data driven due diligence. Our proven assessment framework has guided over 200 companies to technology financial results, generating $100M+ in validated improvements. Let us show you where you stand and where to focus.

See where your technology stands against industry benchmarks with our free online technology health assessment.

Select our Executive or Professional Technology evaluation. Our experts will verify your self-assessment responses and deliver a comprehensive executive summary with findings, solutions, and financial impact.

Receive validated insights and a clear technology roadmap that eliminates second-guessing and gives you the confidence to move forward with a clear buy/sell position.

All 7 Assessment Areas

Per Assessment Area

In the same way that Quality of Earnings provides financial clarity for an acquisition or sale, technology due diligence is critical to avoid unforeseen costs and insights to your deal. While many companies rely on assumptions and incomplete data, our structured assessment approach delivers certainty with financial direction.

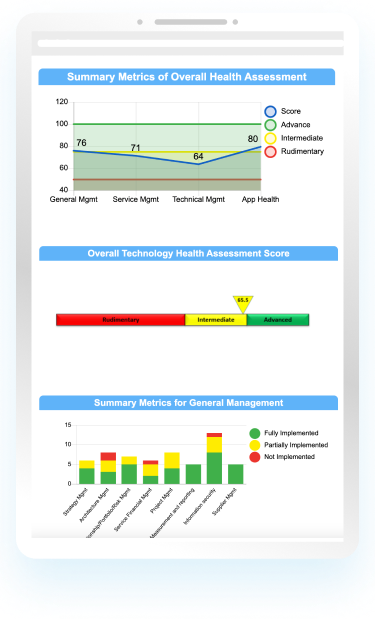

We evaluate seven core domains: from IT service management and security to software development and applications. Each area is benchmarked against insights from hundreds of past assessments, with our SMEs reviewing 400+ proven best practices to ensure thorough analysis.

Our analysis identifies not just potential risks, but delivers specific solutions with associated costs. By examining the relationships between all technology areas, we provide a comprehensive view that strengthens your negotiating position. You’ll understand exactly how the technology measures against industry standards and what that means for deal value.

This disciplined approach transforms technology assessment from a checkbox exercise into a strategic advantage. We accelerate the process through our proven methodology, delivering board-ready reports that compare findings against thousands of past results. With clear metrics and actionable insights, you can move forward with the same confidence you get from earnings due diligence.

With over 200 assessments completed, our process has been refined to deliver maximum value in minimal time. Our expert SMEs and former CIOs provide the oversight you need, while our comprehensive benchmarking data gives you the context to make informed decisions. Whether you’re buying, selling, or optimizing your current technology position, our assessment provides the clarity you need.

Ready to strengthen your deal position? Schedule a call to learn how our technology assessment can drive value for your next transaction.

Technology leaders deserve better than hunches when making strategic decisions. At Risk Optima, we give you the hard data you need across seven essential domains to know exactly where you stand, and solutions to move forward with certainty.

Copyright © AcquireTek 2025. All Rights Reserved.